Articles

The relationship between Anti corruption and funding efforts to combat the effects of climate change

- October 9, 2023

- Posted by: mohamed mabrouk

- Category: Middle East Unit Reports Research Papers

By : Mayar Saber Abd Elkader, Shaimaa Adel Mostafa, Salwa Amr Wally

Index

Content ………………………………………… Page number

- List of termenologies

- Introduction

- Climate finance

- Climate finance sources

- public sources.

- Private sources.

- Types of corruption that may face climate finance

- Emmitions trading mechanisms

- Case studies

- Anti-corruption measures to combat climate finance corruption

- Conclusion

- List of refrences

List of termenolgies

- Emissions trading mechanisms : Emissions trading systems are market-based instruments that create incentives to reduce emissions where these are most cost-effective. In most trading systems, the government sets an emissions cap in one or more sectors, and the entities that are covered are allowed to trade emissions permits.

- Kyoto Protocol : an agreement signed among internal leaders to tackle the highly complicated subjected of environment. The agreement was signed on 11 December 1997 with a commitment to reduce carbon dioxide (CO2) and Greenhouse gases (GHG) emissions. The agreement chiefly enforced the developed nations to lower their industrial emissions annually.

- Special Drawing Rights: Special drawing rights (SDRs) are an international type of monetary reserve currency established by the International Monetary Fund (IMF) in 1969 to supplement member countries’ existing money reserves. SDRs were developed in response to concerns about the limitations of gold and dollars as the sole means of settling international accounts, and they supplement international liquidity by supplementing the standard reserve currencies.

- Financial transaction tax: FTT is a catch-all term for taxes levied on transactions involving some sort of financial element, such as currencies or stocks and shares. FTTs are not a new concept; they are used by a number of countries, including some EU member states such as France, Italy, and Spain.

- The International Monetary Fund (IMF): is a United Nations (UN) specialised agency that was established in 1944 at the Bretton Woods Conference to secure international monetary cooperation, stabilise currency exchange rates, and increase international liquidity (access to hard currencies).

- Climate Changr interventions: proposed approaches to accelerating greenhouse gas removal or reducing the amount of heat energy in the climate system in order to reduce warming and its consequences.

- Climate finance: Climate finance refers to local, national, or transnational financing derived from public, private, and alternative sources to support climate change mitigation and adaptation actions. The Convention, the Kyoto Protocol, and the Paris Agreement all call for financial assistance to be provided by Parties with greater financial resources to those with fewer and more vulnerable resources.

- Transparency International: is a global civil society organisation that is at the forefront of the fight against corruption. It creates a community into a powerful global coalition to end corruption’s devastating impact on men, women, and children all over the world.

Introduction

The issue of climate change is one of the most prominent issues on the global agenda today, and to exacerbate it, the international community has sought to find the necessary sources of spending to solve it, and from here a new concept emerged, which is climate finance, which, according to the United Nations, means “the money that must be spent on a full range of Activities that will contribute to slowing climate change and that will help the world reach the goal of limiting global warming to an increase of 1.5°C above pre-industrial levels.”[1]

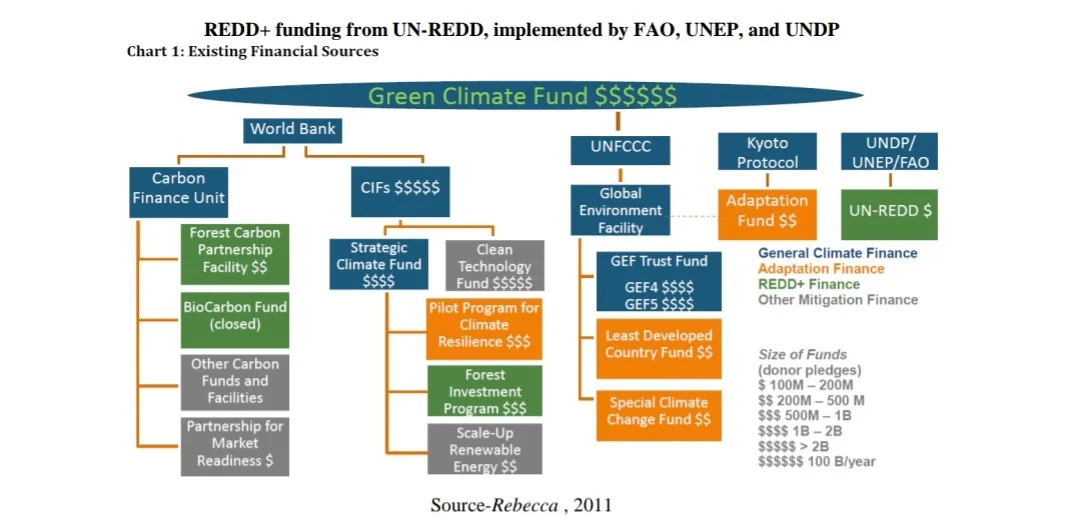

Although the global demand for renewable energy sources is very important because it seeks to preserve the environment and implement mitigation and adaptation policies, financing for the establishment and implementation of renewable energy projects is a very important step, but it is full of difficulties at the same time, because some countries Developing countries do not have sources of climate finance, such as international and regional investments. Therefore, international organizations such as the United Nations are seeking to allocate funding sources for developing countries, such as carbon certificates, which are done as a kind of mitigation of the effects of climate change. A large part of multilateral funding, estimated at billions of dollars, is also directed. Through the Green Climate Fund since 2019, which pays great attention to developing countries and its expenditures include early warning systems and climate-resistant infrastructure. for climate goals.[2]

And within the framework of financing the fight against climate change, the issue of corruption is one of the obstacles in the way of climate financing, as the impact of financing is weakened through the emergence of bribery and embezzlement in funds allocated to mitigate the effects of climate change, and from here, solving the problems of corruption in financing climate change represents a radical solution to the problem of climate change. Its exacerbation leads to the inability to achieve the goals sought by international agreements such as the Paris and Kyoto Agreements, and its solution represents a hope for all peoples in reducing emissions and the success of mitigation and adaptation policies.

What is climate finance?

The international climate talks are focused on a critical issue known as “climate financing” Some of these questions are how much additional funding is needed for mitigation and adaptation, how it will be raised, how resources will be distributed to various recipients in developing countries, and how the results – lowering greenhouse gas (GHG) emissions and adapting to climate change – will be monitored. Climate financing can act as a catalyst to mobilise both public and private resources, create new economic opportunities, encourage the adoption of new technologies, and alter development pathways to improve GHG sequestration, decrease global greenhouse gas (GHG) emissions, and prepare for the negative effects of climate change nations in mitigation and adaptation as well as to embark on green development paths.[3]

Climate financing is defined as “annual financial commitments or capital flows that support climate action, as well as cumulative sums of private investment or public fund capital” over time measurements must be made using real-year monetary units and a common currency.[4]

What are the future sources of climate finance?

- International Maritime Shipping: Limiting GHG emissions from this industry could bring in money through levies, carbon offsets, or the sale of allowances. The annual output from this technology might range from US $2 to $19 billion.

- International Aviation: A market-based method has been suggested to reduce aviation-related GHG emissions, such as sectoral cap-and-trade. Estimates suggest that such a mechanism might earn US $1–6 billion annually, with the US contributing 41%, the EU 22%, the remaining annex countries 14%, and non-annex countries 23%, respectively.

- Direct Budget Contribution: Developed countries commit to allocating a specific amount of money from their national budgets to climate funding. Although it is contingent on the willingness of affluent countries to make and keep promises, developing countries prefer this approach depending on the political and economic circumstances at the time. Fast Start Finance’s current size (US $30 billion over three years) reflects the size of this source.

- Financial Transaction Tax (FTT): Every trade in financial products, including stocks and currency, would be subject to a global 0.005% tax, according to this source. While putting such a system in place would necessitate a tool for international taxation and collection, estimates suggest that it could generate US $2-27 billion per year.

- Special Drawing Rights: Philanthropist George Soros emphasised the use of Special Drawing Rights (SDRs), which are “reserve assets” created by the International Monetary Fund, at the Copenhagen climate change conference in December 2009. (IMF). According to Soros, a quick infusion of SDRs could result in a $100 billion “fast-start green fund” for climate finance, which could contribute to a solution that meets the mitigation and adaptation needs of poor countries.[5]

What are the different types of climate finance sources?

Climate finance can come from very different sources, which can include: public or private, national or international, bilateral or multilateral.

1- public sources

1- public sources

The public sector directly donated between $6 and $12 billion8. Contributions from ministries and government organisations in wealthy countries that finance initiatives in developing countries make up the majority of this. Because there is insufficient data on them, the global domestic public budgets for addressing climate change are not included. Domestic public climate budgets, however, may be “at least 60 billion USD annually according to CPI”.

Public-sector intermediaries

The other and primary component of public sector finance is public intermediaries. Climate finance, Development Finance Institutions (DFIs) such as National and Multilateral Development Banks (NDBs and MDBs), and Bilateral Financial Institutions are all included (BFIs). Public intermediaries pledged approximately 128 billion USD in climate finance flows. These organisations typically provide financial and technical assistance to project development operations in poor countries. The Global Environment Facility (GEF), MDBs, NDBs, BFIs, and climate funds are the most common types of public intermediaries.

International Facility for Environmental Cooperation

In 1991, the United Nations Development Program (UNDP), the United Nations Environmental Program (UNEP), and the World Bank collaborated to establish the Global Environment Facility (GEF). The Global Environment Facility prioritises issues such as biodiversity loss, desertification, and climate change. The GEF operates as an operating institution of the UNFCCC’s climate change finance mechanism. 10 Since its inception, the GEF has awarded grants totaling USD 13.5 billion and assisted in the acquisition of USD 65 billion in co-financing for projects in developing countries. In 2014, the GEF Council approved funding for the sixth funding cycle, which runs from 2014 to 2018. Thirty donor countries pledged a total of USD 4.43 billion11, with between USD 1.22 and USD 1.37 billion available for climate change mitigation.

international development banks

The Asian Development Bank (ADB), African Development Bank, European Investment Bank, and World Bank are commonly regarded as the primary MDBs (AfDB), inter-American Development Bank, and European Bank for Reconstruction and Development (IADB). The MDBs’ initial priorities were economic growth and poverty eradication, but they are now gradually incorporating climate change into their activities. Large MDBs typically have in-house knowledge, allowing them to pioneer complex financial products and assess the risks of new technologies with promise but no track record.

National Development Banks

NDBs are government-backed financial entities that promote the involvement of private financial intermediaries in order to facilitate the improvement of financial conditions in local financial markets. NDBs can combine numerous small-scale projects by employing a portfolio strategy, streamlining procedures, and lowering transaction costs.

International lending institutions

National governments establish and supervise bilateral finance institutions (BFIs) with the goal of investing in or assisting certain developing countries. Bilateral development cooperation organisations, such as BFIs, frequently award grants with only a development goal in mind, though BFIs also have a profit goal14. The Federal Ministry for Economic Cooperation and Development (BMZ), for example, is a bilateral development cooperation organisation, whereas the KfW Group is Germany’s primary BFI.

In recent decades, the majority of BFIs and cooperative organisations have incorporated climate finance into their development initiatives, making them important sources of climate money; a large number of these BFIs participated in the establishment of (multilateral) climate funds, such as the United States, France, and others.[6]

Climate fund

Multilateral and national climate funds have approved approximately USD 2.2 billion in climate money, but there is currently only a modest flow8. Grants and low-cost debt are the primary forms of project financing used by climate programmes, but it is expected that this relatively new source of funding will become more significant as a means of transferring cash from rich to developing nations.

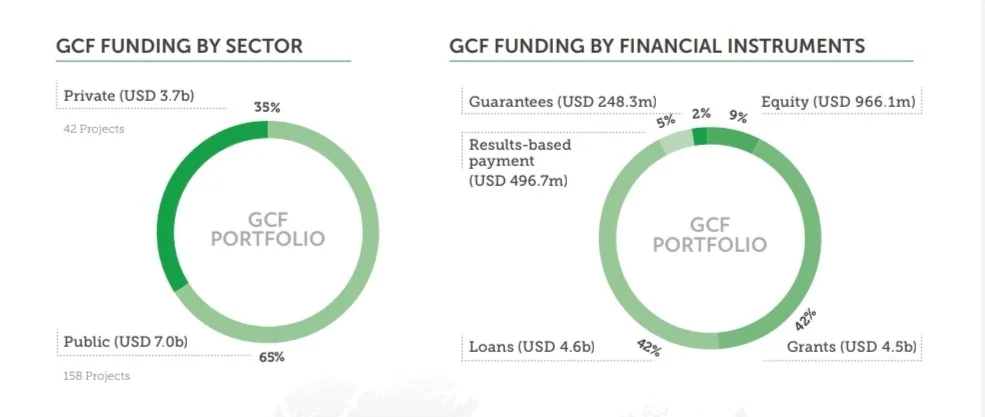

- The Green Climate Fund: – It is one of the largest funds related to climate finance and seeks to support developing countries to reduce greenhouse gas emissions in addition to adapting to the climate, in addition to the annual contribution of the member states of the European Union with 95% of voluntary pledges.[7]

- Adaptation Fund: The Adaptation Fund allocates approximately $850 million to help developing countries adapt from planning to implementation while ensuring full oversight and transparency.

- Clean Technology Fund: “The Technology Fund is at the fore in financing renewable energy technologies such as concentrated solar energy.” This fund allocates about $5.3 billion to expand low-carbon technologies, in addition to $4 billion to implement renewable energy and transportation.[8]

- Private sources

GCF has created the Private Sector Facility (PSF), a specialised division created to fund and mobilise private sector players such as institutional investors, project sponsors, and financial institutions in order to scale up GCF’s activities and de-risk capital flow delivery. PSF encourages private sector investment through special financing options such as low-interest, long-term project loans, lines of credit for banks and other financial institutions, equity investments, and risk-reduction strategies such as guarantees, first-loss insurance, and grant-based capacity-building initiatives. PSF organises these tools based on various methodologies, such as climate innovation, climate markets, project finance, and so on.[9]

In this picture shows some of the contributions of the Green Climate Fund regarding mitigation and adaptation to some developing countries, especially

African countries. [10]

Finance from Private Sources

A wide range of private sources can be used to finance private investment as long as risk-return expectations are met. 17 Private companies, local, regional, and international commercial banks, non-bank financial institutions, leasing companies, private equity investors, and institutional investors are among them.

Financing schemes can take many different shapes and levels of complexity. A private sector project could, in its most basic form, be funded on the company’s balance sheet, which will include shareholder equity as well as short- and long-term debt. Private equity funds or capital markets share issues may provide additional equity financing. Debt can be obtained through borrowing from a bank or through the sale of bonds on the capital markets.

or another type of commercial paper Financing plans frequently become more complex as project complexity increases, and a variety of financial instruments may be used to complete a financing plan in a large project finance structure. Contractual arrangements containing feed-in tariffs or other price support, such as take-or-pay provisions, can, for example, serve as collateral or otherwise provide lenders with comfort a specific project or technological solution. [11]

What are Corruption types that may face climate finance process ?

Corruption is a major impediment to the rule of law and long-term development. Every institution around the world recognised the negative impact of corruption, which impedes economic growth and development, undermines public trust, legitimacy, and transparency, and impedes the creation of fair and effective laws, as well as their administration, enforcement, and adjudication. As it is a case that attracted the whole world attention in the last few decades, it was so hard to find a clear and comprehensive definition of corruption. But one of the most known and accepted definitions is the world bank one’s .Corruption is defined by the World Bank as a form of dishonesty or crime committed by a person or organization entrusted with power in order to obtain illegitimate advantages or to abuse that power for the benefit of the individual.There are various types of corruption that exist and are affirmed by the World Bank, such as economic corruption, political corruption, administrative corruption and institutional corruption . The main type of corruption that will be discussed in the paper is economic corruption, as climate finance is a field of the economy so the case of corruption is going to be studied in an economical side .[12]

Corruption in climate finance has a negative impact on climate change intervention, undermining mitigation efforts to reduce emissions and lowering the quality of adaptation infrastructure in both cases, donors and other funders suffer financial loss or misuse. More research is needed to determine the precise role of corruption in CF, but the potential impact on emissions is obvious. Corrupt acts (for example, bribery, illegal gifts, kickbacks, unmanaged conflicts of interest, or lobbying) can erode the quality of environmental regulations, resulting in lower emissions standards. Reduce the effectiveness of clean energy programmes, and thus their impact of emissions, by allocating funds to less deserving or no projects. Increase deforestation rates by encouraging authorities to ignore illegal tree cutting, resulting in less carbon being captured. Prolong or encourage investments in nonrenewable energy, resulting in increased emissions and failure to meet reduction targets. Allow corporate interests to use lobbying to ‘capture’ individual politicians or the state as a whole, thereby shifting government policy away from climate action.[13]

What is the relation between corruption and emissions trading mechanisms ?

Emissions trading mechanisms are regulatory frameworks for quantifying and commoditizing greenhouse gas emissions, allowing those emissions to be traded as financial instruments among economic actors. These frameworks convert emissions into financial instruments such as tradable units, credits, and certificates for emission reductions, depending on the system’s specifics. These markets, which were conceived in the years preceding the signing of the Kyoto Protocol in 1997 as a means of achieving the goals outlined in the United Nations Framework Convention on Climate Change of 1992 (UNFCCC), now mobilize approximately US$167 billion. Emissions trading systems are frequently lauded as a powerful and cost-effective approach to dealing with climate change’s multifaceted challenges. According to the UNFCCC, these systems will contribute a significant portion of the funds required for climate change mitigation. Member countries of the Organization for Economic Cooperation and Development (OECD) have already pledged up to $100 billion by 2020 and agreed to contribute up to $30 billion in “fast-track finance” between 2010 and 2012 to fund adaptation and mitigation actions.[14]

The implementation and expansion of emissions trading mechanisms are expected to mobilise a large portion of these financial resources. Corruption has an impact on the success of emissions trading schemes because it reduces the overall reliability and effectiveness of GHG markets. Cases of fraud and bribery, abuses of power, and other traditional forms of corruption have repeatedly tainted the implementation of cap-and-trade systems in both developed and developing countries. Corruption in this sector has also taken on more novel forms, such as the profiteering from ‘bad science’ and scientific uncertainties, manipulation of GHG market prices, and anti-systemic speculation.

Case studies :

There is many real cases that happened in the world countries that proves the role of corrubtion in reducing climate finance and make loses for donors ,other funders and the working institutions and in the following paragraphs some of those cases :

- Bribery in forest carbon capture, such as in (REDD+), a project involving 65 partner countries. In Indonesia, three forest conservation projects were harmed by illegal logging, artisanal mining, and palm oil plantation. Villagers claimed that private companies bribed local government officials and police in exchange for ignoring these activities. The main effect was on emissions. Corruption reduced expected carbon capture by about 15%, based on the percentage of area degraded by illegal activities. The lesson is that systemic flaws, such as a lack of monitoring or reporting mechanisms, must be identified and corrected, and perpetrators prosecuted.[15]

- The Mafia targeted the sector in response to a new Italian government policy promoting renewable energy through the construction of windfarms. Three people, including a former provincial governor, conspired to control a committee and demanded kickbacks in order to allocate windfarm licences and construction contracts. The three men were charged with conspiracy to defraud, bribery, and favouritism. Personal enrichment, rather than increasing clean energy, became the driving force behind windfarm development. One man was sentenced to seven years in prison, while the former governor was sentenced to two years for abuse of office.

- Jakarta in Indonesia is increasingly vulnerable to catastrophic flooding as a result of subsidence caused by excessive ground water extraction and rising sea levels (40% of the city is below sea level). To better manage incoming sea water, the Indonesian government is constructing a US$40 billion ‘giant dyke’ in Jakarta Bay that will include 17 new islands (the design phase was funded by Netherlands). The director of the company building one island bribed a city councillor with US$148,000 in order to avoid planning regulations. Due to environmental, social, and corruption concerns, the entire project was halted in 2016. The company’s director was sentenced to three years in prison and the city councilor to ten years because this project was so important in the infrastructure system of the city in addition to its serious results as the halting of the project has delayed flood protection for millions of people.[16]

It is critical to emphasise that corrupted environmental governance systems contribute to species extinction, over-exploitation of natural resources, pollution and degradation of ecosystems and wildlife habitats, the spread of diseases and invasive species, and the deprivation of local stakeholders who rely on wildlife and plants for subsistence. Mitigation and adaptation strategies required to mitigate the impact of climate change, like other sectors of environmental governance, are vulnerable to the actions of corrupt actors. Indeed, as mitigation and adaptation actions become more urgent, the negative impact of corruption in various industries and political actors is likely to grow this is due to the fact that the increasing economic value of climate governance decisions and initiatives fosters the perverse economic incentives that drive corruption.[17]

What anti-corruption measures are in place to combat climate finance Corruption?

The levels of emissions are the result of complex interactions between multiple variables. income, urbanisation, industrialisation, forestry policy, energy policy, and so on environmental governance quality. Climate change interventions can work in while working in tandem with industrial, forestry, and energy policies to reduce emissions, but optimising better understanding and management of their corruption risks.[18]

Corruption in Climate Finance has two fundamentally negative effects:

- Mitigation measures fail to reduce carbon emissions as desired, and may even increase them.

- Adaptation measures will be ineffective.[19]

The former affects everyone, whereas the latter affects specific beneficiaries. Donors and other funders lose or misuse funds in both cases. While more research is needed to determine the precise role of corruption in CF, its potential impact on emissions is clear. Corruption (for example, bribery, illegal gifts, kickbacks, etc.)

Conflicts of interest (or lobbying) that are not managed can:

- Reduce the rigour of environmental regulations so that emissions standards are met.

- Reduce the effectiveness of clean energy programmes, and thus their impact on emissions, by directing funds to less deserving – or non-existent – projects

- Increase deforestation rates by encouraging authorities to ignore illegal treecutting, resulting in less carbon being captured.[20]

Transparency International’s corruption risk mapping techniques are being used to assess how corruption affects climate finance and action. We discovered a lack of transparency, participation, and accountability in the use of funds set aside to combat climate change. Countries are expected to be transparent about how and what they do to combat climate change under the Paris Agreement. This necessitates transparency on a variety of issues, including emission levels, the impact of climate change, adaptation and mitigation efforts, and financial support.[21]

National and subnational governments are being more open and transparent about their climate change policies. They must be able to collect, process, and share information so that policymakers, local communities, and businesses can participate and make informed climate action decisions. The ability to access and share information is critical for the successful implementation of the Paris Agreement.

Corruption has an aggravating effect in weakening the process of mitigating the consequences of climate change, as there are many measures that must be taken to implement sustainable development strategies, in which bodies need to refer to state agencies and problems occur in the event of corruption that leads to the disruption of those strategies and their failure to implement them with the required efficiency.[22]

Case Studies:

One of the most important efforts of Egypt in this regard is the legal framework to combat corruption, the most important of which is the Penal Code issued in 1937, which criminalized many corruption crimes that affect the financing of climate change through the occurrence of corruption crimes such as bribery and forgery and others. The most important of these laws are those contained in Chapters Three and Four of the Penal Code, which include cases of bribery and embezzlement, as some cases of fraud in carbon markets or embezzlement of funds allocated for mitigation or adaptation operations for personal interests appear.

A set of penalties that emphasized the application of imprisonment and fines to perpetrators. The application of policies to improve transparency, integrity and governance values prevents the occurrence of corrupt practices in the bodies concerned with the procedures necessary to establish renewable energy projects and others. One of the most important laws that have been developed in this regard is Law No. 106 Which is known as (preventing conflict of interest), some of which states that government employees are not allowed to buy shares or hold positions in companies or projects, which prevents embezzlement or bribery attempts that may affect climate finance.[23]

Climate change action must acknowledge the danger that grand corruption poses to its goals. Despite having contributed the least to the problem and having the fewest resources to address it, developing countries will bear a disproportionate share of the costs of climate change, particularly climate finance. It is important to note that several international institutions, such as the United Nations and the World Bank, seek to combat corruption in order for those who donate or fund climate issues to ensure that funds reach climate change projects without being embezzled or wasted. [24]

Conclusion

Finally, it is crucial to remember that climate change is now affecting us all, and it is our responsibility to protect it with the same zeal and determination. Furthermore, we discussed climate finance, which refers to annual financial commitments or capital flows that support climate action. Furthermore, we have discussed future sources of climate finance, which include, but are not limited to (international sea freight – international aviation).

As for the sources of public funding, they consist of ministries and governmental organizations in developed countries, as the main component of funding are public intermediaries such as national development banks and bilateral financial institutions. In addition, we talked about the International Facility for Environmental Cooperation and how to complete the financing process. As for private financing, we talked about climate funds, especially the contributions of the Green Climate Fund and the Air Conditioning Fund, in addition to the contributions of commercial banks, whether local, regional or international, and private companies.

Multilateral funds can maximise the effectiveness of mitigation and adaptation programmes by actively and explicitly incorporating integrity, transparency, accountability, inclusiveness, and zero tolerance for corruption into climate funding and action. Participatory policy dialogue and training, improved lobbying practises, better laws and policies, open data, monitoring and reporting mechanisms, and whistleblower protection are all strengthened by the highest standards in these areas.

Only by preventing corruption can climate practitioners and stakeholders ensure that the world’s climate funding and adaptation programmes are as effective as possible. Climate finance recipients desperately need and deserve it. The recommendations we propose will increase trust in the power of climate finance, ultimately increasing funding to those in greatest need.

Regarding the challenges of climate finance, particularly the corruption that it faces in various forms, and how countries and the international world work to address these crises in order to achieve the desired results for those rules established to limit the negative effects of climate change, we have relied on clarifying Egypt’s role in this point and how the state works in accordance with international agreements to solve that problem.

References

- Åsa, Persson, Aaron Atteridge, Elise Remling, Magnus Benzie, and Harro van Asselt. “Protecting climate finance: An anti-corruption assessment of the Global Environment Facility’s Least Developed Countries Fund & Special Climate Change Fund.” (2014).

- Aur, Sandra “An Analytical Study of the Contribution of Carbon Markets to Financing Climate Change”, Journal of Financial, Accounting and Management Studies, No. 2, December 2020, https://www.asjp.cerist.dz/en/article/145205

- Anti-Corruption Resource Centre “Corruption and Climate Finance.” n.d.. https://www.u4.no/publications/corruption-and-climate-finance

- Bhowmik, Debesh. key features and dimensions of climate finance, international journal of scientific and research publications, volume 3,April 2013, http://ijsrp.org

- Climate Investment Funds “Clean Technologies.” 2017.. July 28, 2017. https://www.climateinvestmentfunds.org/topics/clean-technologies.

- Green Climate Fund. “Private Sector Financing.” June 9, 2020. https://www.greenclimate.fund/sectors/private

- CPI “Global Landscape of Climate Finance 2021.”. https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2021

- Green Climate Fund, 2020. Response to allegations reported by Financial Times. 26 August. Inchon.

- international finanace cooperation Climate Finance: Engaging the Private Sector, November 2011, https://www.cbd.int

- Intergovernmental Panel on Climate Change (IPCC), 2018. Global warming of 1.5°C. Geneva: United Nations.

- Introduction of climate finance, United Nation climate change, https://unfccc.int/topics/introduction-to-climate-finance .

- Josué, Banga,. “The green bond market: a potential source of climate finance for developing countries.” Journal of Sustainable Finance & Investment 9, no. 1 (2019): 17-32.

- Martin, Walter and Luebke, Michelle, The Impact of Corruption on Climate Change: Threatening Emissions Trading Mechanisms? (March 1, 2013). UNEP Global Environmental Alert System, March, 2013 UNEP/GRID- Sioux Falls, Available at SSRN: https://ssrn.com/abstract=2259312

- Michael, Nest, and Saul Mullard. “Lobbying, corruption and climate finance: The stakes for international development.” U4 Issue (2021).

- Nations, United. “Financing Climate Actions | United nations.” United Nations. https://www.un.org/en/climatechange/raising-ambition/climate-finance.

- org. “Corruption-Free Climate Finance: Strengthening Multilateral Funds -….” n.d. Accessed September 18, 2022. https://www.transparency.org/en/publications/corruption-free-climate-finance-strengthening-multilateral-funds

- . UN News“The Trillion Dollar Climate Finance Challenge (and Opportunity).” 2021. June 26, 2021. https://news.un.org/en/story/2021/06/1094762.

- United Nations “Financing Climate Actions | United nations.”. https://www.un.org/en/climatechange/raising-ambition/climate-finance

- worldbank.org Climate Action and Corruptions Risks.” n.d. Blogs.. Accessed August8,2022.https://blogs.worldbank.org/ar/voices/altsdy-ltghyr-almnakh-wmharbt-alfsad